Understanding the various types of orders in the stock market is vital for successful investing and trading. Each order type has its own characteristics and can significantly influence your trading strategy and outcomes. In this blog, we will explore the most common types of orders and discuss their functions and benefits those investors or traders should be aware of.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

List of contents

- What is the order in the share market?

- Types of orders

- Conclusion

Read also: Best platform for mutual funds?

What is the order in the share market?

An order is simply an instruction given to a broker or online trading platform to buy or sell a specific financial instrument on your behalf. These instruments can include stocks, commodities, currencies, ETFs, REITs, bonds, and more. Each order type has its own distinct characteristics. As an investor or trader, you can place an order through your stock broker’s mobile or web interface, and it will be executed on the relevant stock exchange

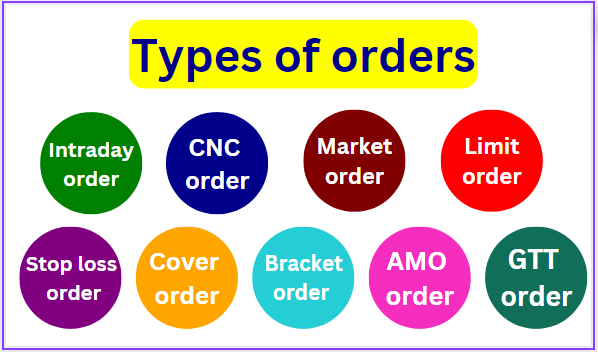

Types of Orders

When new users attempt to buy or sell stocks using a broker’s app or web platform, the numerous options available can be confusing. However, understanding these order types makes trading easier.

Order types based on time horizon:

There are two types of orders based on the time horizon:

1) CNC or delivery order: A CNC or delivery order is used when you want to buy and hold stocks for more than a day. After purchase, the stock units are transferred to your demat account by the stock exchange. you also choose this order when you want to sell stocks that you have previously bought and held in your demat account.

“CNC signifies ‘Cash and Carry,’ indicating that the investor plans to retain the shares in their demat account after executing the order.

2) INTRADAY ORDER: An intraday order, also called MIS (margin intraday square-off), is used by traders for buying or selling stocks within the same trading day. These orders are not meant for holding stocks overnight, and any open positions are automatically closed by the exchange at the end of the day. Traders commonly use intraday orders to take advantage of price fluctuations during a single day. Traders specifically use this type of order for intraday trading.

Order types based on price:

Here are some major types of orders:1) Market order (MO): A market order is a type of order where you can buy or sell a security immediately at the current market price. It guarantees that your order will be executed promptly, but it doesn’t guarantee the exact price at which it will be executed. Market orders are popular among individual investors and traders who want to buy or sell a stock without delay. With this type of order, you don’t need to specify a price, as it executes at the current market price.

2) Limit order (LO): A limit order is an order to buy or sell a security at a specific price or desired price. When you place a buy limit order, it will only be executed at the limit price or lower. Similarly, a sell limit order will only be executed at the limit price or higher. This order type allows you to set a desired price for the trade, and it will only be filled if the market reaches that price. If the desired price is not reached, the order will not be executed.

3) Stop-loss order (SL order): A stop-loss order is used to prevent losses beyond your risk tolerance when the market moves against your expectations. It involves setting a specific price, known as the stop price, at which you want to buy or sell a stock.

There are two types of stop-loss orders:

Stop Loss Limit Order (SL-L): This order combines the features of a stop loss and a limit order. It specifies both the stop price and the limit price. If the stock price falls to the stop price, the order is activated as a limit order to sell the stock at the limit price or better.

Stop Loss Market Order (SL-M): This order is placed to sell a stock at the market price when its price reaches or falls below the stop price. It helps limit potential losses by triggering a market order to sell the stock once the stop price is reached.

4) Cover order (CO): In a cover order, traders place both the entry price (buy/sell price) and stop loss at the same time. Intraday traders specifically use it. The advantage of using a cover order is that you don’t need to separately place a stop-loss order for your open positions. When placing a cover order, you specify both the entry price and the stop-loss price. If the entry price is triggered, a market order is executed, and simultaneously, a stop-loss order is placed to limit potential losses.

5) Bracket order (BO): An OCO (One Cancels the Other) or bracket order is placed based on a predefined risk-reward ratio in mind for any given position before it gets initiated by a trader. It combines three different order types: an entry price (buy/sell order), a stop-loss order, and a target order. Intraday traders specifically use it

A bracket order automatically cancels the other order if the stock reaches either the target price or the stop-loss trigger price after initiating the trade. If the stop-loss order is triggered, the target order will be cancelled, and vice versa.

This order type helps traders manage their positions by automatically booking profits and covering potential losses. It ensures a systematic approach to trading and allows for efficient risk management during intraday trading.

6) AMO (after market order): An AMO (after market order) is placed after the market closes and before the next day’s market opens. It allows you to place orders during non-market hours, either before or after the regular trading session. The market executes these orders when it reopens on the next trading day. AMO orders are useful for investors and traders who cannot trade during regular market hours but still want to participate in the market based on their investment decisions.

7) GTT ORDER: A GTT (good till trigger) order allows investors to set specific conditions for executing a trade. Once these conditions are met, the order is triggered and executed. Unlike other order types, GTT orders don’t expire at the end of the trading session but remain active for up to 1 year or until the investor cancels them.

Investors commonly use it to set targets or stop-loss levels for their long-term holdings. GTT orders can be placed for delivery or margin products, but not for intraday trading. Some brokers offer GTT order services, so it’s important to check if your broker provides this option.

To open zerodha account :- Click here

Read also: Forex trading in India

Conclusion

To maximise profits and effectively manage risks in the stock market, investors and traders should be familiar with different types of orders and their unique features. Choosing the right order type is crucial for achieving investment or trading objectives. Each order type serves a specific purpose, catering to various trading strategies and risk preferences. Understanding your requirements and placing the appropriate order can minimise losses and help achieve target prices.

Happy trading!

I hope you enjoyed reading this. Please share it with other and do comment!

Read also: Rich dad poor dad quotes