Welcome to the exciting world of forex trading in india, where a plethora of opportunities await traders. As India’s economy continues to flourish and financial markets open their doors to individual investors, it has gained immense popularity among Indian traders.

In this blog, we will explore the basics of forex trading in india, the major currency pairs, and the benefits of it.

“The goal of a successful trader is to make the best trades. Money is secondary” – Alexander Elder

List of contents

- What is forex trading in india?

- Basics of forex trading

- Major currency pairs

- Benefits of forex trading in india

- Disadvantage

- Conclusion

Read also: What is fundamental analysis?

What is forex trading in india?

forex trading, also known as currency trading, is the process of buying and selling different currencies to make a profit from their changing exchange rates.

In India, it is done through futures and options contracts on the NSE and BSE. unlike share trading, currencies are not traded in the spot market. Additionally, there are no weekly futures contracts available for currency trading. Furthermore, unlike other markets, currency trading in India does not have a pre-market session.

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate currency trading in India to maintain a fair and transparent market. The RBI establishes rules and guidelines, ensuring that these trading activities operate smoothly and without any irregularities.

Basics of forex trading

Timing: The trading hours for currency markets in India are from Monday to Friday, 9 a.m. to 5 p.m.

Lot Size: In futures and options trading on exchanges, every instrument is traded in lot sizes. Here are the lot sizes for some currency pairs:

1 lot of USDINR equals 1000 units of the US dollar.

1 lot of EURINR equals 1000 units of the euro.

1 lot of GBPINR equals 1000 units of the pound sterling.

1 lot of JPYINR equals 100,000 units of the Japanese yen.

Tick size: it represents the smallest possible change in the price of a financial instrument, such as a stock, currency pair, or commodity.

As we know, the tick size of shares is 5 paisa (0.05). This means that the minimum increase or decrease in the price of each share occurs in increments of 0.05. Similarly, in currency trading, the tick size is 0.25 paisa (0.0025 Rs), which is one-fourth of 1 paisa. For example, a currency movement of 1 tick on 1 lot corresponds to a price movement of 2.5 Rs.

Liquidity: In terms of liquidity, the ranking for currency pairs is as follows: USDINR > EURINR > GBPINR > JPYINR.

Expiry: In currency trading, contract expiration is structured as follows:

1) Weekly expiration contracts, including weekly options, expire on the Friday of the expiring week.

2) Contracts other than weekly ones, such as monthly futures and options, expire two working days before the last working day of the expiry month at 12:30 pm.

Mode of settlement: In currency trading (forex trading) the mode of settlement is cash settled in Indian rupees.

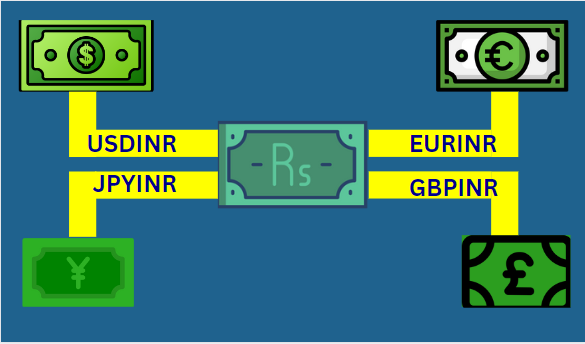

Major currency pairs

In the Indian forex market, traders have the opportunity to trade major currency pairs involving the Indian Rupee (INR) and other global currencies such as the US Dollar, Euro, British Pound, and Japanese Yen. These major currency pairs include USDINR, EURINR, GBPINR, and JPYINR.

In these currency pairs, the base currencies are USD, Euro, Pound, and Yen, while the quotation currency is INR. For example, in USDINR, the US dollar (USD) is traded against the Indian rupee (INR).

Benefits of forex trading in india

The major benefits are as follows:

- Leverage: One of the biggest benefits of currency trading in India is the availability of leverage. it enables traders to control larger positions in the market, potentially leading to higher returns.

- Margin: While doing currency trading in zerodha, the margin requirement for 1 lot varies. For USDINR, it is approximately 1800 Rs; for EURINR and JPYINR, it is around 2700 Rs; and for GBPINR, it is about 4000 Rs. It’s important to note that the margin is not fixed and may change as the price of the currency pair fluctuates.

Disadvantage

- High Risk: The leverage involved in currency trading can amplify both profits and losses. The leverage provided in this is more than 40 times greater, which amplifies both profits and losses in a proportional manner.

- Complexity: It is complex and requires a deep understanding of economic factors, geopolitical events, and market trends. It can be challenging for new traders to keep up with these complexities, and a lack of knowledge or experience can lead to poor trading decisions and financial losses.

To open zerodha account :- Click here

Read also: Rich dad poor dad quotes

Conclusion

forex trading in india offers great potential for individuals seeking financial growth and diversification. By understanding the basics, such as major currency pairs and the potential benefits, one can take advantage of currency trading. However, it is important to be aware of the associated risks and complexities. With proper knowledge, effective risk management, and thoughtful decision-making, this can be a rewarding instrument for traders and investors.

I hope you enjoyed reading this. Please share it with other and do comment!

Read also: Benefits of investing in stock market